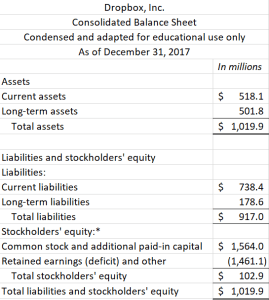

Dropbox, Inc. has filed an SEC report, indicating that it plans to raise $500 million through its Initial Public Offering (IPO) sometime in 2018. It will be issuing common stock. Dropbox was started in 2007 and is designed to allow people to have their files anywhere they are. There are over 500 million registered Dropbox users worldwide. When Dropbox makes its IPO, its existing preferred stock will be converted into common stock. To follow is Dropbox’s pro forma balance sheet as of December 31, 2017. The “pro forma” refers to the stockholders’ equity section; this condensed and adapted balance sheet shows what Dropbox’s stockholders’ equity section would have looked like at December 31, 2017, if all of its preferred stock had already been converted to common stock.

Questions

- When Dropbox issues these common stock shares through its IPO in exchange for cash, what impact will that stock issuance have on Dropbox’s assets, liabilities, and equity?

- What impact, if any, will the Dropbox IPO have on its current ratio? On its debt ratio?

- Why might Dropbox be choosing to issue stock rather than incur more debt to raise cash?

- Will this IPO have any direct impact on Dropbox’s income statement? Explain.

Instructor Resources

These resources are provided to give the instructor flexibility for use of Accounting in the Headlines articles in the classroom. The blog posting itself can be assigned via a link to this site OR by distributing the student handout below. Alternatively, the PowerPoint file below contains a bullet point overview of the article and the discussion questions.

- Student handout (pdf) (word) (contains entire blog posting + discussion questions)

- PowerPoint file (brief article overview + discussion questions)

Copyright 2018 Wendy M. Tietz, LLC

March 27, 2018

March 27, 2018

Just wondering what instructor resources you are referring to? I’d like to use this in class but thought you might have some question responses available.

Lina: The instructor resources are the handouts and the PowerPoint files. I do not provide answers because the questions are meant to generate discussion (might not have only one answer) and some instructors use the questions as graded assignments. Have a nice day:-) Wendy